In today’s business world, companies are under more pressure than ever to do more with less. Rising costs, tighter margins, and increasing competition make it critical to run lean and agile operations, especially in finance. However, while finance departments are often expected to be the stewards of efficiency across the organization, they are not immune to inefficiencies within their operations. In fact, inefficient finance processes can silently drain time, money, and energy, holding back your company’s growth potential.

In this essay, we’ll explore what inefficiency looks like in the finance function, how to identify the hidden costs, and practical steps you can take to streamline operations. We’ll also learn from real experts and thinkers who have helped shape modern financial strategy.

The Hidden Cost of Doing Things “The Way They’ve Always Been Done”

One of the biggest barriers to efficient finance is tradition. Legacy systems, outdated spreadsheets, manual approvals, and paper-based processes can become deeply ingrained in a company’s culture. Although they may have been effective in the past, these outdated methods create bottlenecks today. Finance teams often spend hours reconciling data from different sources, manually inputting numbers, or chasing down signatures for approvals.

The cost of this inefficiency isn’t just time—it’s lost opportunities. A report by The Hackett Group found that world-class finance organizations spend 46% less per transaction than their peers and use 41% fewer full-time employees per billion dollars of revenue. This means that inefficient companies are burning money by keeping bloated, manual processes alive.

Author and lean management expert Jim Womack, who co-wrote Lean Thinking, emphasizes that waste isn’t just a factory problem—it’s a business-wide issue. He argues that identifying and removing waste from administrative and finance processes can have just as much impact as cutting waste in manufacturing. In his words, “every business process is a process, and every process can be improved.”

What Does Waste Look Like in Finance?

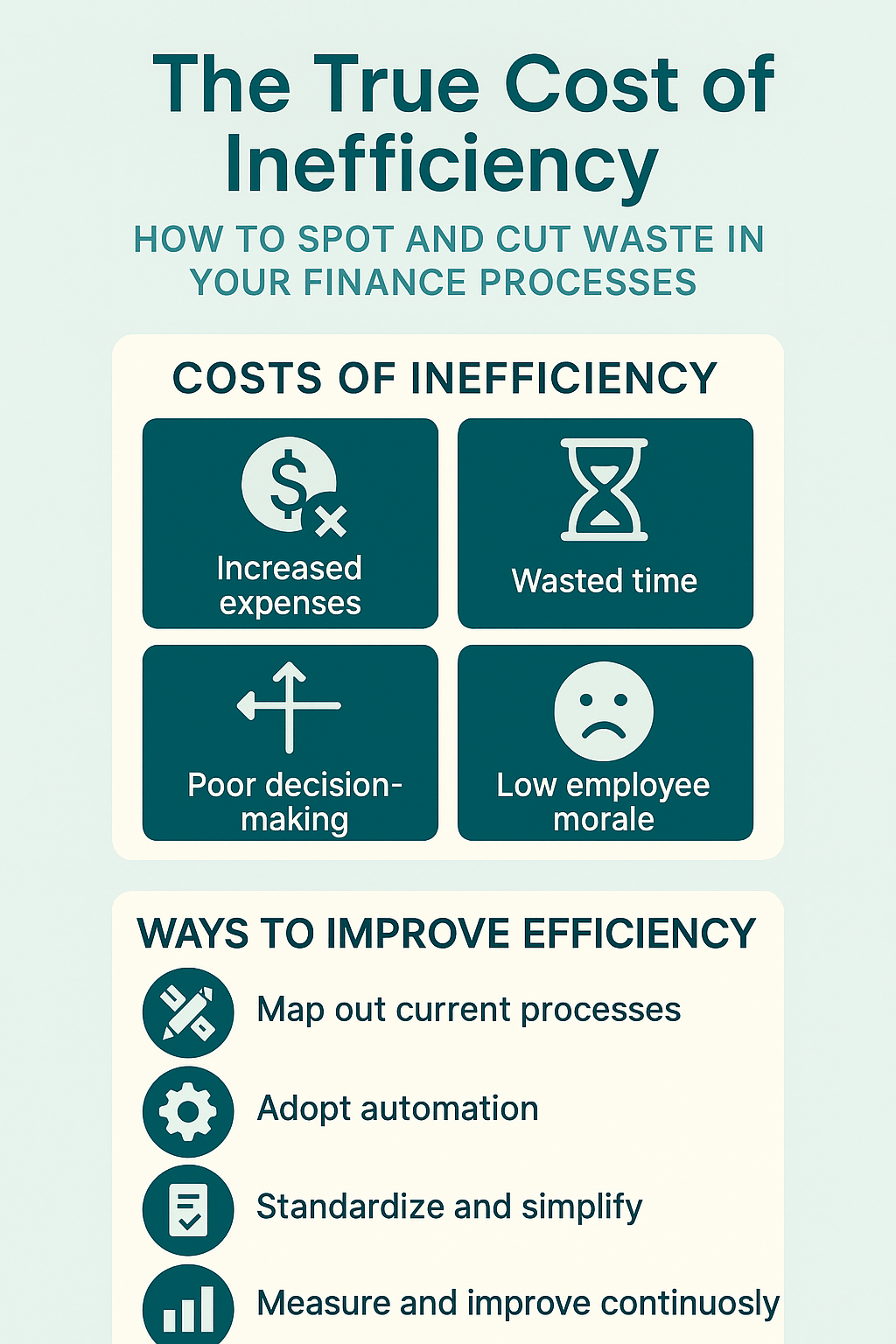

Before you can eliminate waste, you must recognize it. Finance waste comes in many forms, and not all of it is easy to detect. Here are some common red flags:

- Too Much Manual Work: If your team is entering the same data into multiple systems or relying heavily on spreadsheets to close the books, that’s a sign of inefficiency.

- Delayed Reporting: Reports that take weeks to prepare to lose their value. If decision-makers aren’t getting timely insights, your finance team may be working hard, but not smart.

- Lack of Standardization: When different departments or locations use varying formats or systems, consolidating data becomes a daunting task.

- Frequent Errors and Rework: Repeating work to fix mistakes isn’t just frustrating—it’s expensive.

- Inefficient Approvals: If it takes days to get a purchase order signed off, your process is costing you time and possibly even lost discounts or deals.

How to Cut the Waste and Boost Efficiency

Improving financial efficiency doesn’t always require a massive system overhaul. In fact, small, consistent improvements often make the biggest difference. Here’s how to start:

1. Map Out Your Current Processes

Begin by documenting how things are actually done, not just how they’re supposed to be done. This process mapping helps you identify pain points, bottlenecks, and unnecessary steps. Use simple tools, such as flowcharts or sticky notes, to visualize workflows.

2. Adopt Automation Where It Matters

Automation is not about replacing people—it’s about freeing them to do work of higher value. Tools such as accounts payable Automation, expense management software, and AI-powered forecasting platforms can automate repetitive tasks and reduce human error.

As finance futurist Daniele Tedesco, CFO at EY Italy, says: “Automation empowers finance teams to shift from being data gatherers to insight providers. The true value lies in decision support, not data entry.”

3. Standardize and Simplify

Create standard templates and reporting formats. Make sure every team and region is aligned on terminology, systems, and processes. This consistency eliminates confusion and reduces reconciliation time.

4. Invest in Training and Upskilling

Your tools are only as good as the people using them. Invest in training your team on new technologies and analytical thinking. Help them develop the skills to interpret data and drive strategy, not just report numbers.

5. Measure and Improve Continuously

Establish KPIs to track performance, such as time to close books, transaction cost per invoice, or reporting turnaround time. Make process improvement a habit, not a one-time project.

The Human Cost of Inefficiency

It’s easy to think about inefficiency purely in financial terms, but the human toll is just as important. When finance teams are bogged down with repetitive, low-impact work, morale suffers. Talented professionals want to spend their time solving problems, analyzing trends, and adding value, not copying and pasting numbers all day.

Leadership expert Patrick Lencioni, author of The Five Dysfunctions of a Team, reminds us that disengaged employees are one of the biggest hidden costs in any organization. A finance team that feels stuck in a loop of manual drudgery will not deliver innovation or strategic insight.

Conclusion: Lean Finance Is Smart Finance

Inefficiency in finance isn’t just an operational issue—it’s a strategic risk. In a world where decisions must be made quickly and with precision, slow and wasteful processes can put your entire organization at a significant disadvantage.

However, there’s good news: waste can be identified, addressed, and reduced. By modernizing tools, streamlining workflows, and empowering your people, you can build a finance function that’s lean, effective, and ready to lead.

In the words of Jim Womack: “The enemy of lean is not waste. The enemy of lean is failure to see the waste.” Start seeing it and start cutting it. Your bottom line—and your team—will thank you.

Leave a comment