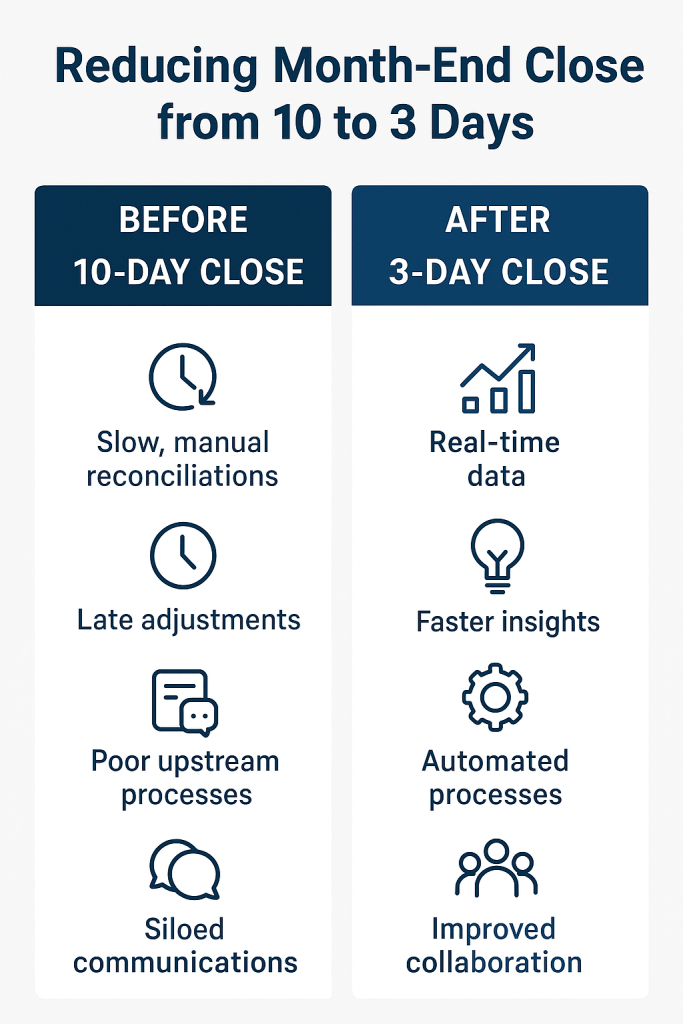

Business Case: Reducing Month-End Close from 10 to 3 Days

For many finance teams, the month-end close process is a marathon. The moment the month ends, accountants and analysts dive into reconciliations, accruals, journal entries, and variance analysis. In some companies, this takes 10 days or more. By the time the numbers are ready, managers are already deep into the next month, making decisions without the most up-to-date information.

Reducing the close cycle from 10 days to just 3 days isn’t just about speed — it’s about empowering the business with timely, reliable insights that drive better decisions. It’s a transformation that requires process improvements, technology adoption, and a mindset shift across the finance organization.

Why the Month-End Close Takes So Long

A long, close process often stems from:

- Manual reconciliations — Spreadsheets, email chains, and manual data entry slow down progress.

- Late adjustments — Invoices, accruals, and intercompany transactions trickle in well after month-end.

- Poor upstream processes — Inconsistent coding, missing approvals, and late submissions create rework.

- Siloed communication — Finance teams chase operational managers for data instead of having automated feeds.

This time lag creates a dangerous ripple effect. As Tom Hood, CPA and CEO of the Maryland Association of CPAs, often notes: “The faster you can close, the faster you can coach your business leaders.” If finance spends two weeks just reporting the past, there’s little time left to advise on the future.

The Business Case for a Faster Close

Moving from a 10-day to a 3-day close delivers benefits well beyond efficiency.

- Fresher insights. When the books close quickly, leadership can see last month’s performance while it’s still relevant. This means faster course correction, not just post-mortems.

- More time for analysis. As Jack McCullough, author of Secrets of Rockstar CFOs, points out, “Elite CFOs spend less time on the close and more time on decision support.” Shortening the close frees capacity for budgeting, forecasting, and strategic planning.

- Lower risk of errors. Long closes invite fatigue, late-night crunching, and rushed reviews. A streamlined process with automation and controls often produces more accurate results.

- Improved morale. Finance teams working 12-hour days for two weeks straight risk burnout. A 3-day close improves work-life balance and talent retention.

- Stronger reputation. Faster, cleaner reporting enhances credibility with investors, auditors, and internal stakeholders. It signals operational maturity.

How to Achieve a 3-Day Close

This transformation doesn’t happen by decree. It’s the result of deliberate process redesign and cultural change.

1. Shift from “Closing the Books” to “Continuous Close”

Instead of waiting until month-end to reconcile accounts, post accruals, and review transactions, high-performing finance teams do these tasks throughout the month. Daily or weekly reconciliations, automated bank feeds, and rolling accrual updates dramatically reduce the end-of-month workload.

2. Standardize and Automate

Document every step in the close process. Then, look for bottlenecks and replace manual tasks with automation:

- ERP systems with auto-reconciliation features

- Workflow tools for journal approvals

- Pre-built report templates instead of ad-hoc queries

As Steve Player, co-author of Future Ready: How to Master Business Forecasting, has said, “Standardizing reduces chaos, and automation eliminates it.”

3. Integrate Upstream Processes

The close depends on timely, accurate data from purchasing, sales, operations, and payroll. Set clear deadlines for invoice submissions, expense reports, and approvals. Better yet, integrate these processes directly into your ERP so the data flows in real time.

4. Implement Materiality Thresholds

Many teams waste time chasing tiny variances that don’t materially affect the financials. Define clear thresholds for adjustments — for example, not booking accruals under $500. This reduces “noise” and speeds the close without impacting accuracy.

5. Improve Cross-Department Collaboration

Host a pre-close meeting with accounting, FP&A, operations, and department heads to review pending items and clear blockers before day one. This proactive approach prevents the “hunt” for missing data after the clock starts.

Case Example

Consider a mid-sized manufacturing company that historically took 12 days to close. By:

- Moving reconciliations to a weekly cadence

- Automating journal entries for recurring transactions

- Enforcing a 48-hour cutoff for expense submissions

- Establishing a $1,000 materiality limit

…the company reduced its close to 3 business days within six months. The CFO reported that management could now review the prior month’s results during the first week, which allowed sales and operations leaders to take immediate corrective actions.

Potential Challenges

- Cultural resistance — Staff may feel that speed compromises accuracy. Clear communication about controls and data integrity is essential.

- Technology investment — Automation tools and ERP upgrades require upfront costs, but these are offset by the long-term efficiency gains.

- Change fatigue — Too many process changes at once can overwhelm the team. A phased approach works best.

Measuring Success

Track progress with metrics such as:

- Close duration (calendar days)

- Number of late adjustments

- Error rate in post-close reviews

- Time spent on analysis vs. preparation

Over time, you should see not only a shorter close cycle but also higher confidence in the numbers and more engaged business partners.

Conclusion

Reducing the month-end close from 10 days to 3 days is not simply a finance efficiency project — it’s a strategic enabler. It gives leaders fresher insights, creates space for forward-looking analysis, and signals to investors and employees that the company is agile and well-managed.

As Jack McCullough notes, “The close is a means to an end, not the end itself.” The ultimate goal is not to close the books fast — it’s to close them well, so the business can act quickly and confidently on the story the numbers tell.

Leave a comment