In manufacturing, inventory is both a necessity and a burden. It ensures uninterrupted production and customer service, but it also ties up cash, inflates carrying costs, and increases the risk of write-downs. For CFOs and finance leaders, the challenge is clear: how to reduce stock levels, improve inventory turnover, and convert assets into liquidity without disrupting operations or customer relationships.

While operations and supply chain teams traditionally own inventory management, the commercial function—encompassing sales and marketing—plays an equally critical role in converting stock into cash. Improving inventory turns is not just an operational efficiency project; it’s a cross-functional financial strategy.

Why Inventory Turns Matter

The inventory turnover ratio—calculated as Cost of Goods Sold ÷ Average Inventory—measures how efficiently a company moves stock.

- High turnover means faster movement, less cash tied up, and stronger liquidity.

- Low turnover means cash is sitting idle, margins are under pressure, and the balance sheet is carrying risk.

For example, if a manufacturer reduces inventory days on hand (DIO) from 90 to 60, that’s a 33% reduction in working capital tied up. The freed-up cash can fund growth, reduce debt, or cushion volatility—without needing to raise external capital.

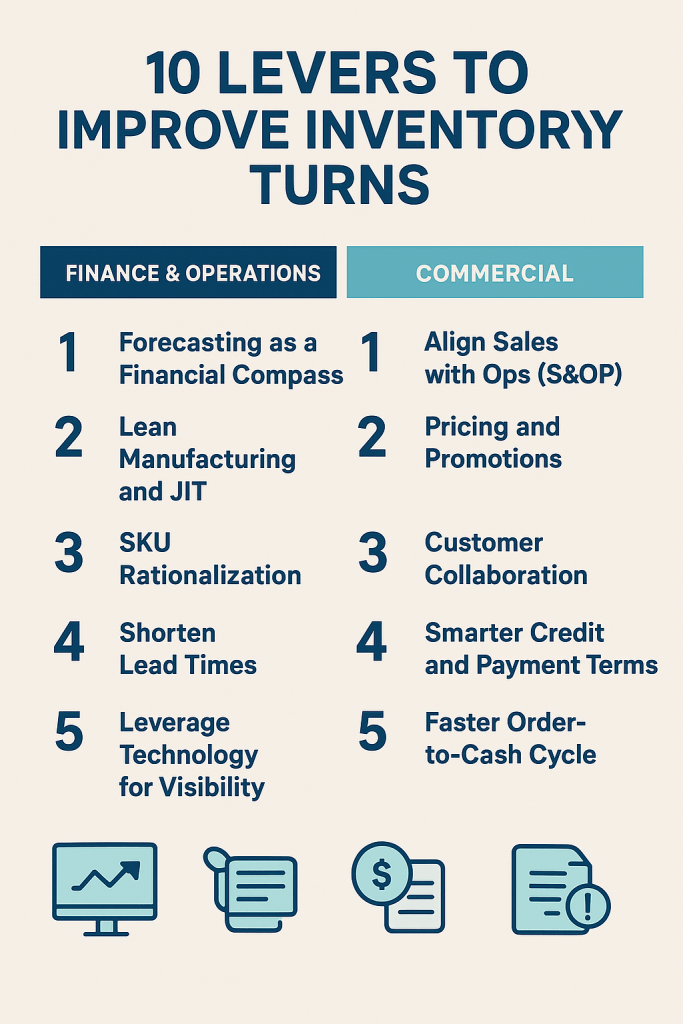

Finance & Operations Levers to Improve Inventory Turns

1. Forecasting as a Financial Compass

Forecasting isn’t perfect, but it is critical. Finance teams must treat demand planning as a financial control tool. Moving from static annual forecasts to rolling, data-driven projections reduces excess stock and improves alignment between production and customer demand.

Financial impact: Fewer stockouts, lower DIO, and tighter working capital.

2. Lean Manufacturing and Just-in-Time (JIT)

Operationally, JIT reduces waste; financially, it reduces working capital requirements. Producing only what’s needed—supported by supplier collaboration and safety stock discipline—lowers average inventory balances without harming service levels.

Financial impact: Improved liquidity and lower carrying costs.

3. SKU Rationalization

Every product line consumes capital. Commercial pressure often leads to SKU proliferation, but many variants are low-margin and slow-moving. An ABC analysis helps companies focus on high-value, high-demand items while phasing out low-return SKUs.

Financial impact: Less capital tied to non-performing inventory and lower write-down risk.

4. Shorten Lead Times

Long supplier lead times necessitate that manufacturers hold more inventory as a buffer. By renegotiating contracts, dual sourcing, or improving production setup times (e.g., SMED techniques), companies can reduce the stock required to maintain service levels.

Financial impact: Shorter cash conversion cycle (CCC) and reduced carrying costs.

5. Leverage Technology for Visibility

ERP and predictive analytics systems allow finance and operations teams to track turnover, DIO, and aging stock in real time. These tools help flag obsolete inventory, optimize order quantities, and simulate demand scenarios to prevent them from impacting cash flow.

Financial impact: Avoidance of write-downs and more accurate working capital forecasting.

The Commercial Side: Driving Inventory Into Cash

Operations can only do so much. To truly accelerate turnover, manufacturers must involve the commercial function:

6. Align Sales with Operations (S&OP)

Sales has the closest view of pipeline shifts, upcoming promotions, and customer demand. When this intelligence is integrated into the S&OP process, production volumes reflect actual demand rather than outdated assumptions.

Impact: Less excess stock and more predictable cash flow.

7. Pricing and Promotions for Excess Stock

The commercial team can design promotions or strategic discounts to accelerate the sale of slow-moving or obsolete inventory. Liquidating at a slight discount is often more profitable than holding or writing down inventory.

Impact: Faster conversion of inventory into cash, reduced working capital drag.

8. Customer Collaboration

Through collaborative forecasting, blanket orders, or vendor-managed inventory agreements, commercial teams can reduce the need for manufacturers to carry large buffers.

Impact: Lower DIO, more predictable receivables, and smoother cash flow.

9. Smarter Credit and Payment Terms

Sales can also help optimize the order-to-cash cycle by negotiating more favorable terms—such as upfront deposits, shorter payment periods, or incentives for early payment. Faster cash collection complements leaner inventory, thereby shortening the overall cash conversion cycle.

Impact: Improved liquidity and stronger balance sheet.

A Cross-Functional Imperative

Reducing inventory isn’t just a supply chain initiative—it’s a finance, operations, and commercial collaboration.

- Finance sets the working capital targets and measures performance.

- Operations manages production efficiency and stock optimization.

- Commercial drives demand, customer alignment, and pricing levers.

When all three functions are aligned, manufacturers don’t just reduce stock levels—they unlock cash, strengthen liquidity, and improve resilience.

As lean expert Richard Schonberger once wrote: “Inventory is money sitting around in another form.” The challenge—and opportunity—for manufacturers is to move it faster and smarter.

References

- Schonberger, R. J. (1982). Japanese Manufacturing Techniques: Nine Hidden Lessons in Simplicity. Free Press.

- Womack, J. P., & Jones, D. T. (1996). Lean Thinking: Banish Waste and Create Wealth in Your Corporation. Simon & Schuster.

- Bragg, S. (2014). Inventory Accounting: A Comprehensive Guide. Accounting Tools.

- Christopher, M. (2016). Logistics & Supply Chain Management (5th ed.). Pearson Education.

Leave a comment